How to settle your company in the Netherlands: 7 tips you need to know before expanding to new horizons

The Netherlands is emerging as a prime destination for businesses looking to expand within Europe, providing a wealth of advantages for companies aiming to strengthen their presence in the EU. Known for its highly educated, multilingual workforce with a strong command of English, as well as advanced digital infrastructure, the Netherlands offers a welcoming environment for international businesses. This blend of a pro-business atmosphere, excellent transportation networks, and innovation-driven policies make it a key gateway for global companies entering the European market.

Post-Brexit, the Netherlands has become a preferred choice for companies needing a stable EU base to maintain their European market reach. The country’s commitment to EU regulations, proximity to the UK, and reliable trade environment provide a seamless alternative for companies impacted by Brexit. Dutch policies on customs and regulatory compliance offer straightforward solutions for managing post-Brexit trade requirements, allowing businesses to continue their European operations with confidence.

In this article, TheHRchapter will explore the essential steps for setting up a company in the Netherlands. We’ll cover topics to understand the Dutch labor and regulatory requirements. By following these tips, you’ll be well-prepared to establish a strong business foundation in the Netherlands and set your company up for long-term success in the European market.

Tip 1: Understand the Netherlands as a Tech and Business Hub

- The Netherlands is one of Europe’s leading tech hubs, attracting startups, scaleups, and major tech corporations like Tesla, Meta, IBM, and Google. Cities such as Amsterdam, Eindhoven, and Rotterdam each contribute uniquely to this thriving ecosystem, with Amsterdam as a center for tech startups and events, Eindhoven for high-tech and semiconductor R&D, and Rotterdam for innovation in logistics and maritime sectors. Supported by a skilled workforce and strong focus on digital innovation, Dutch startups created over 256,000 jobs globally in 2023, further boosting the sector’s rapid growth.

- Additionally, government initiatives such as Invest-NL and Techleap, along with organizations like the Netherlands Point of Entry, offer funding, mentorship, and support, making the Netherlands a prime destination for tech innovation and business expansion.

Tip 2: Registering Your Company with the KVK (Chamber of Commerce)

To legally operate a business in the Netherlands, all companies must register with the Netherlands Chamber of Commerce, known as the Kamer van Koophandel (KVK). This registration is a fundamental step in establishing your business, as it provides you with a unique KVK number, essential for invoicing, communications, and complying with Dutch tax requirements.

This flowchart shows you all the steps of the

registration process:

Tip 3: Setting Up Payroll and Employee Benefits

The Dutch payroll system requires tax withholdings and social security contributions. Employers must withhold income tax, social security, and healthcare contributions, with rates varying by income bracket. For instance, income over €75,518 is subject to a 49.5% tax rate.

Many companies use payroll software tailored to Dutch regulations, which helps ensure timely wage payments, tax compliance, and detailed payslip issuance, which is legally required.

Payroll outsourcing is a popular choice, especially for companies unfamiliar with Dutch payroll requirements. Dutch payroll service providers often manage complex payroll tasks, including tax calculations, payslip preparation, and annual tax submissions, reducing administrative burdens and mitigating compliance risks. This is particularly beneficial for international companies or startups new to Dutch employment laws.

Tip 4: Drafting a Contract of Employment in Compliance with Dutch Law

- A Dutch employment contract must specify critical aspects, including job title, job description, salary, and standard working hours. Additional elements include location(s) of work, start date, and details of holiday entitlements and holiday pay, which typically amounts to an extra 8% of the annual salary.

- Contracts in the Netherlands can be either fixed-term, indefinite or zero hours, each with specific rules. Dutch law limits temporary (fixed-term) contracts to a maximum of three consecutive contracts or a total of 36 months, after which a permanent (indefinite) contract must be offered. Aditionally, a zero-hours contract is a type of employment agreement for an on-call worker, where they are paid solely for the hours they actually work.

Tip 5: Choosing Insurance Options for Your Company

- The Dutch system of mandatory insurance for employers and health insurance for all residents creates a strong safety net, fostering a sense of security for workers and residents. These requirements ensure that businesses can handle unexpected liabilities, workers have income security during illness or injury, and all residents, including expatriates, have access to healthcare.

- In the Netherlands, employers are required to have liability insurance to cover damages from business-related injuries or property damage involving employees or third parties. Additionally, while there isn’t a designated “workers’ compensation” system, employers must financially support employees who become ill or injured due to work, paying at least 70% of their salary for up to two years. This protection is often managed through sick pay insurance and supplementary policies, ensuring employees maintain income security during recovery.

- Finally, all residents, including expatriates, must have basic health insurance (“basisverzekering”) from private Dutch insurers, covering essential medical services. While employers often help with costs, individuals are responsible for obtaining coverage.

Tip 6: Establishing a Pension Plan for Your Employees

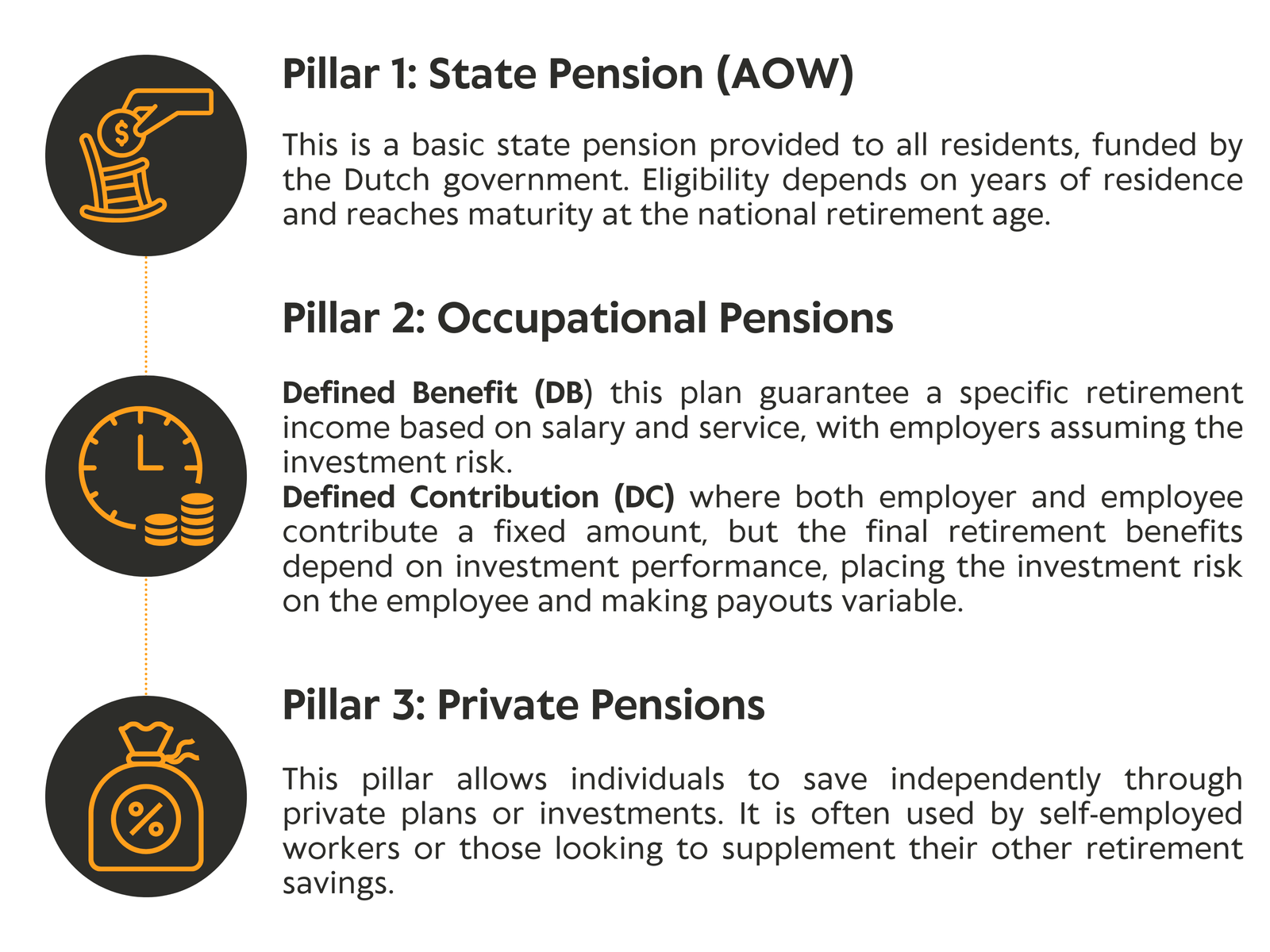

The Dutch pension system is well-developed and structured into a three-pillar system to support financial security for residents in retirement.

Many sectors, such as healthcare, construction, and public services, require mandatory participation in occupational pension plans due to sector-wide agreements. In industries without such mandates, employers can voluntarily offer pension plans as part of their benefits package, enhancing their appeal to employees and providing additional retirement security.

Tip 7: A competitive remuneration package (total rewards)

- Employers in the Netherlands often use benchmarking to ensure their compensation packages are competitive within the industry. Long-term incentives (LTI), such as stock options and performance-based rewards, are common in senior or specialized roles to foster long-term employee retention. Short-term incentives (STI), including bonuses and profit-sharing, motivate employees to meet immediate goals and align with company objectives.

- Dutch employers frequently offer additional perks like health insurance contributions, pension plans, travel allowances, and flexible work options, supporting work-life balance and employee well-being. Many companies also invest in training and development budgets for courses and certifications, promoting employees’ career growth.

- Dutch employers often offer perks like health insurance contributions, pension plans, travel allowances, and flexible work options, all of which are valued in the Netherlands for promoting work-life balance and employee well-being. Additionally, many companies provide a training and development budget for courses and certifications, supporting employees’ professional growth and skill advancement.

With a skilled, multilingual workforce, robust infrastructure, and strategic location, the Netherlands is well-suited for companies navigating post-Brexit challenges. By following these steps, companies can build a strong foundation for long-term success in the Dutch and European markets.

At TheHRchapter, we’re here to help make every step of this process seamless and compliant.

Our team offers expert guidance on Dutch labor laws, payroll, benefits, and more, tailored to your company’s unique needs. Whether you’re a startup or an established company expanding into the Netherlands, contact us today to learn how we can support your successful entry and growth in the Dutch market.

Spread the Word!

Enjoyed what you’ve read? Help others discover it too! 📢 Share this article and let’s keep the discussion going.

Related Reads: Check out these other Articles!

Expanding to Europe? Why Hiring Is Where Scale Usually Breaks (and How to Fix It Early)

Expanding to Europe? Why Hiring Is Where Scale Usually Breaks (and How to Fix It…

Agentic AI and HR Ethics: Best practices and ensuring compliance for employees and candidates

Agentic AI and HR Ethics: Best practices and ensuring compliance for employees and candidates There’s…

2025: The Year HR Became Strategic – Key Lessons and Insights for HR Leaders

2025: The Year HR Became Strategic – Key Lessons and Insights for HR Leaders 2025…