Global Mobility Updates: Why you need the A1 Certificate for your relocated employees

As the workforce becomes increasingly globalized, businesses are navigating the complexities of cross-border employment. Employees working abroad—whether temporarily or permanently—introduce not only immigration challenges but also significant considerations around social security compliance. For organizations relocating employees within Europe, understanding and managing these regulations is essential.

Under normal circumstances, social security contributions are paid in the country where an employee works. However, when employees are temporarily assigned or travel for business abroad, questions arise: Where should these contributions be paid? How can compliance with both home and host country regulations be ensured?

To address these challenges, the European Union introduced measures to protect workers’ rights while preventing dual social security contributions. The A1 Certificate is a key instrument in this framework. Issued by the employee’s home country, it serves as proof that the worker continues to contribute to their home social security system, thereby exempting them from contributions in the host country.

Understanding the A1 Certificate

Definition and Purpose

The A1 Certificate (previously known as E101 or E103 form/certificate of coverage) is a document issued by the social security authority in an employee’s home country, certifying that the individual continues to contribute to their home country’s social security system while temporarily working in another EU, EEA country, or Switzerland. This ensures that the employee is exempt from paying social security contributions in the host country, avoiding dual contributions and maintaining continuity of benefits.

Who Needs an A1 Certificate?

An A1 Certificate is essential for various categories of workers, including:

- Business travelers on short-term trips.

- Employees on temporary assignments or secondments.

- Self-employed individuals working across borders or on international posting.

Employers must secure this certificate to ensure compliance with social security regulations. While short business trips may not always mandate an A1 Certificate, obtaining one can simplify compliance and mitigate risks.

Legal Framework

The A1 Certificate is governed by EU Regulation No. 883/2004, which coordinates social security systems across EU member states, the EEA, and Switzerland. This regulation allows employees to maintain coverage under their home country’s system while working abroad temporarily. For non-EU countries with bilateral agreements, similar certificates, such as Certificates of Coverage (CoCs), serve the same purpose.

Importance of Timely Compliance

A1 Certificates are often required for immigration filings, posted worker notifications (PWNs), or labor inspections. In countries like Germany and Luxembourg, presenting an A1 Certificate during these processes is mandatory. Non-compliance can lead to severe financial penalties, such as fines of up to €4,000 per employee in France, increasing with repeat offenses.

Additionally, with growing collaboration between labor, immigration, and social security authorities across Europe, non-compliance in one area can prompt investigations in others. This highlights the importance of securing A1 Certificates before assignments begin, ensuring legal and financial protection for both employers and employees.

Consequences of Non-Compliance

Failing to obtain an A1 Certificate for employees working temporarily in another EU/EEA country or Switzerland can lead to serious financial and legal repercussions for both employers and employees.

To avoid these risks, employers must secure A1 Certificates for employees before any business travel or assignments in another EU/EEA country or Switzerland. Proactively ensuring compliance protects your company from financial losses, operational disruptions, and legal issues, while safeguarding the well-being of your globally mobile workforce.

Practical Tips for Employers

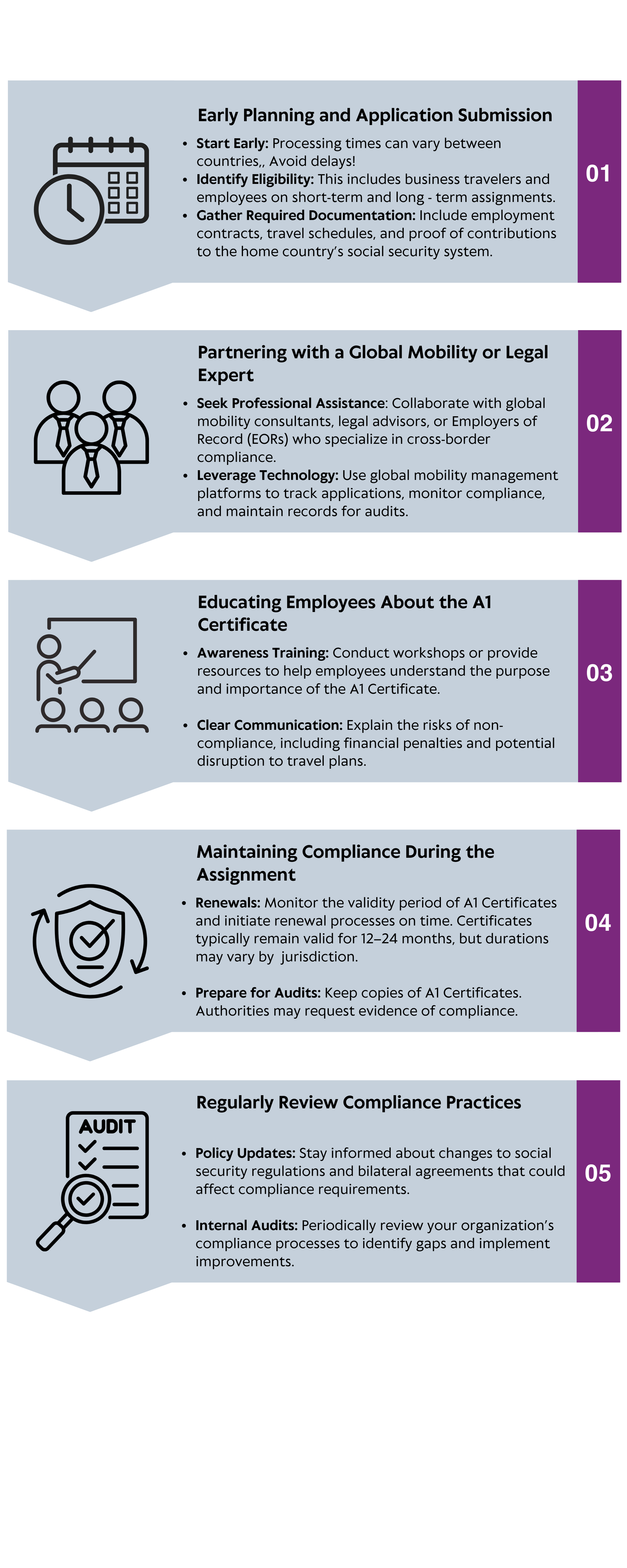

Managing global mobility effectively demands a proactive approach to ensure full compliance with social security regulations, especially when employees are traveling or relocating across the EU, EEA, or Switzerland. To help streamline the process and minimize risks, TheHRchapter offers these practical tips:

Ensuring compliance with social security regulations is a critical aspect of managing global mobility, particularly in the EU, EEA, and Switzerland. The A1 Certificate plays a pivotal role in simplifying cross-border employment, safeguarding employees’ benefits, and avoiding dual contributions or costly penalties.

By adopting a proactive approach—planning ahead, educating employees, and partnering with global mobility experts—employers can navigate the complexities of international assignments with confidence. Maintaining compliance not only protects the organization from financial and legal risks but also demonstrates a commitment to supporting a globally mobile workforce.

Unlock Compliance and Harmony with TheHRchapter

Navigating labor laws and managing employee relations are essential for maintaining a productive and compliant workplace. At TheHRchapter, we provide expert guidance on labor law compliance and offer tailored solutions to manage employee relations effectively.

Our team specializes in:

- Ensuring compliance with international and local regulations.

- Offering personalized strategies to support global mobility.

- Fostering a positive and harmonious work environment while reducing legal risks.

Let us help you streamline compliance, manage employee relations, and create a thriving, legally sound workplace. Contact TheHRchapter today to learn how we can support your organization and your globally mobile workforce!

Social Security Authorities in Europe:

For employers and employees seeking an A1 Certificate, it is important to know where it can be requested. The following are the key social security organizations across Europe that issue A1 Certificates:

- Germany: Deutsche Rentenversicherung (DRV) or health insurance fund (Krankenkasse)

- France: URSSAF (for both employees and self-employed)

- Italy: INPS (Istituto Nazionale della Previdenza Sociale)

- Spain: Tesorería General de la Seguridad Social (TGSS)

- Netherlands: Sociale Verzekeringsbank (SVB)

- Belgium: National Social Security Office (ONSS/RSZ)

- Poland: ZUS (Zakład Ubezpieczeń Społecznych)

- Ireland: Department of Social Protection

- Austria: Austrian Health Insurance Fund (ÖGK)

- Sweden: Försäkringskassan

These organizations ensure that employees continue to contribute to their home country’s social security system while temporarily working abroad, thereby preventing dual contributions and ensuring compliance across borders.

Need help with other HR services for your business?

At TheHRchapter, we provide tailored solutions to guide startups and scaleups in choosing and implementing the best tools for hiring, onboarding, payroll, employee management and more.

Core HR Services

- HR Consulting: Provides expert advice on various HR matters, including policies, procedures, and compliance

- HR Services for Startups: Offers tailored solutions for startups, helping them establish a strong HR foundation.

- Recruitment & Headhunting: Whether you’re looking for fresh talent or niche experts, we ensure a smooth, personalized process tailored to your specific needs.

- Payroll Services: Manages payroll processing, tax filings, and employee benefits.

Let us help you streamline your HR processes and achieve your business goals. Contact us today to get started!

Spread the Word!

Enjoyed what you’ve read? Help others discover it too! 📢 Share this article and let’s keep the discussion going.

Related Reads: Check out these other Articles!

Reskilling and upskilling for the digital age: How HR can lead the change in talent development and succession planning

Reskilling and upskilling for the digital age: How HR can lead the change in talent…

Expanding to Europe? Why Hiring Is Where Scale Usually Breaks (and How to Fix It Early)

Expanding to Europe? Why Hiring Is Where Scale Usually Breaks (and How to Fix It…

Agentic AI and HR Ethics: Best practices and ensuring compliance for employees and candidates

Agentic AI and HR Ethics: Best practices and ensuring compliance for employees and candidates There’s…