How Brexit Affects A1 Certificates and Employee Secondments to the UK

Since the United Kingdom formally left the European Union, the rules governing cross-border employment have undergone significant changes. One area that has seen a notable shift is the treatment of social security coordination for employees temporarily assigned to work in the UK, a practice commonly known as a secondment.

Before Brexit, EU rules allowed for relatively seamless secondments between member states, supported by the use of A1 certificates. These certificates confirmed that an employee remained subject to their home country’s social security system while working temporarily in another EU country, thus avoiding dual contributions. However, the UK’s departure from the EU has raised questions and created complexities around the continued use and recognition of these certificates.

This article explores how Brexit has affected A1 certificates and what it means for employers and employees involved in cross-border secondments to and from the UK. It outlines the current legal framework, highlights the practical implications, and offers guidance on how to remain compliant in the post-Brexit environment.

What is an A1 Certificate?

An A1 certificate is a formal document issued under Regulation (EC) No 883/2004, which governs the coordination of social security systems within the European Union (EU), as well as in the European Economic Area (EEA) and Switzerland. Its primary function is to confirm which country’s social security legislation applies to an individual who is working across borders within these territories.

For employees who are temporarily posted to work in another EU/EEA country, the A1 certificate is essential. It verifies that the employee continues to be covered by the social security system of their home country for the duration of the secondment. This prevents the need to register and contribute to the host country’s system, thus avoiding double social security contributions.

Typically, an A1 certificate is used in situations such as:

- Employee secondments, where a worker is temporarily assigned by their employer to perform duties in another EU/EEA country.

- Multistate work, where an individual regularly works in more than one EU/EEA country (e.g., cross-border commuters, transport workers, or consultants).

- Freelancers or self-employed individuals working temporarily in another member state.

The certificate is issued by the social security authority in the worker’s country of affiliation, and it applies for a limited period (commonly up to 24 months) provided certain conditions are met (such as the temporary nature of the posting and the maintenance of the employment relationship in the home country).

In the pre-Brexit context, the UK was fully part of this coordinated system, meaning that A1 certificates applied seamlessly to secondments between the UK and EU countries. However, since the UK’s withdrawal from the EU, the legal and administrative landscape has changed, leading to new challenges and procedures for employers and employees alike.

Post-Brexit legal framework

The UK’s withdrawal from the European Union marked the end of its participation in the EU’s legal and institutional frameworks, including the EU system of social security coordination under Regulation (EC) No 883/2004. As of January 1, 2021, the UK became a third country in relation to the EU, and the principle of free movement of persons—along with the automatic applicability of EU rules on posted workers and A1 certificates—ceased to apply.

The EU–UK Trade and Cooperation Agreement (TCA)

To fill the legal void left by Brexit, the UK and the EU negotiated the Trade and Cooperation Agreement (TCA), which came into force on January 1, 2021. The TCA includes a Protocol on Social Security Coordination, which serves as the main framework for determining applicable social security laws for mobile individuals, including seconded employees.

This Protocol largely mirrors the aims of Regulation (EC) No 883/2004: to avoid double social security contributions, ensure that individuals are covered by the legislation of only one state at a time, and facilitate the export of certain benefits.

Under the TCA:

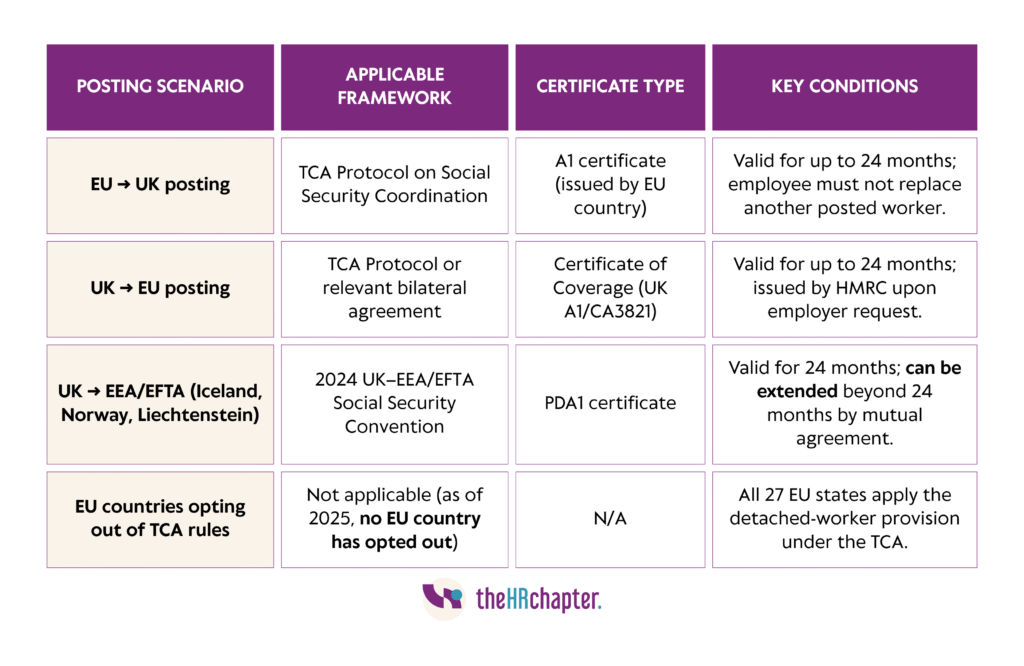

- Employees temporarily seconded from one signatory country to another can remain under their home country’s social security system for up to 24 months, provided all conditions are met.

- This rule applies only if both countries agree to apply the so-called “detached worker” provision. By February 2021, all EU member states confirmed their participation, ensuring broad applicability.

- A1 certificates remain necessary to prove continued coverage under home-country legislation.

However, the TCA does not include a mechanism to extend the 24-month coverage period, which represents a key departure from the pre-Brexit regime, where longer postings were sometimes possible with the approval of both countries.

UK–EEA/EFTA Social Security Convention (Effective January 1, 2024)

To address some of the limitations of the TCA, the UK concluded a new Social Security Convention with EEA/EFTA countries—namely, Iceland, Liechtenstein, and Norway—which took effect on January 1, 2024. This Convention offers a more flexible and comprehensive arrangement than the TCA Protocol.

Key features of the UK–EEA/EFTA Convention include:

- Continued use of PDA1 certificates (the equivalent of A1 certificates) for posted workers.

- The ability to extend social security coverage beyond 24 months in exceptional circumstances, subject to agreement between authorities—reintroducing a level of flexibility absent from the TCA.

- Ensures exportability of benefits, allowing individuals to receive cash benefits even while residing in another participating state.

- Seeks to prevent overlapping benefits, reinforcing administrative clarity and fairness.

This agreement reflects a closer alignment with the original Regulation (EC) No 883/2004 and suggests a willingness by both sides to maintain strong social security coordination for mobile workers, even in a post-Brexit context.

Looking ahead: Evolving UK-EU relations

As of mid-2025, ongoing discussions between the UK and EU have indicated a broader “reset” in diplomatic and economic relations, including plans for closer cooperation in youth mobility and education. While these discussions do not directly modify the current social security framework, they signal the potential for future enhancements in cross-border mobility arrangements, which may have indirect effects on social security coordination and secondments.

Current rules for A1 Certificates post-Brexit

The following table summarizes the current rules regarding the use of A1 certificates (or equivalent certificates of coverage) in the post-Brexit environment:

Employers should ensure that the correct certificate is secured before the assignment begins. Certificates must be retained and presented in case of inspection by host-country authorities. Failure to secure or present an A1/certificate of coverage can lead to liability for host-country social security contributions.

Practical implications for employers and HR

For employers and HR professionals managing international assignments between the UK and EU/EEA/EFTA countries, the post-Brexit social security framework introduces new layers of responsibility and risk. While the principles of avoiding double contributions and ensuring workers remain covered have been preserved, compliance now requires additional vigilance.

Key practical implications include:

- Additional administrative steps: Employers must apply for the appropriate certificate (A1 or PDA1/certificate of coverage) through national authorities before the employee begins their secondment. Failure to do so may result in coverage lapses.

- Risk of double contributions: Without a valid certificate, workers may become liable for social security in both the sending and receiving countries. This creates financial risk for both employer and employee and can lead to retrospective charges.

- Monitoring time limits: Most certificates are limited to 24 months under the TCA and the UK–EEA/EFTA Convention. HR teams must track assignment durations carefully and consider end dates or potential extensions (where allowed).

- Internal coordination: Secondments now require closer coordination between HR, legal, payroll, and compliance teams. Clear documentation (such as assignment letters, employment contracts, and travel records) is critical to proving eligibility and maintaining

Common challenges and pitfalls

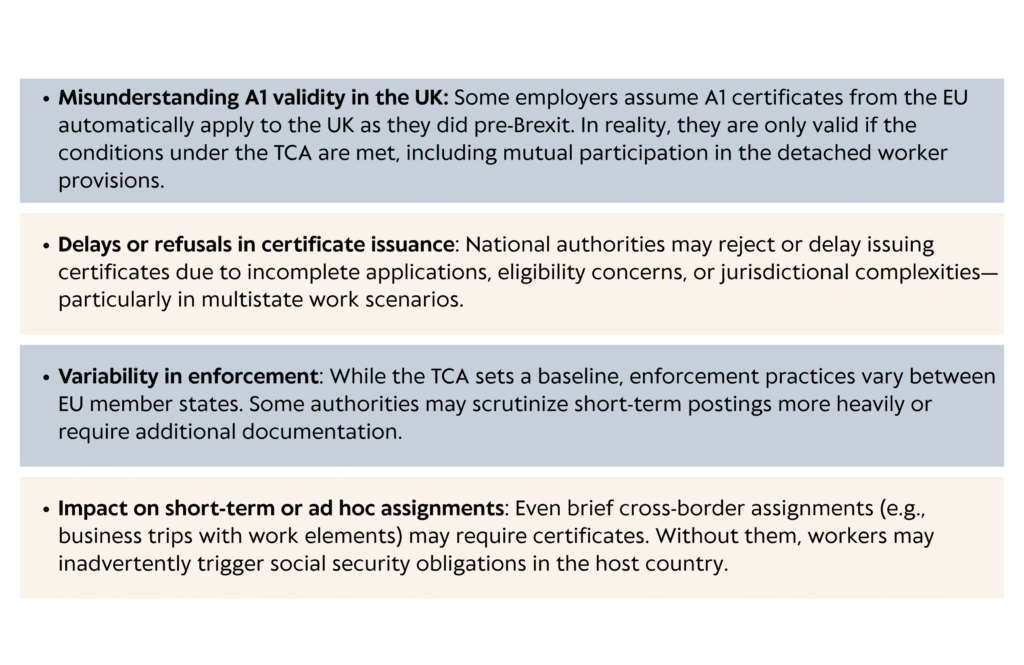

Despite the existence of legal frameworks, employers and assignees frequently encounter issues in practice. Awareness of these common challenges can help mitigate delays, non-compliance, and disputes:

Recommendations and best practices

Navigating the post-Brexit landscape for cross-border secondments requires careful planning, thorough documentation, and up-to-date knowledge of evolving regulations. Employers must balance administrative demands with legal compliance while minimizing disruption to their business operations.

Here are key steps to help ensure a smooth secondment process:

- Plan early and review eligibility: Evaluate potential secondments involving the UK as early as possible. Confirm whether the employee qualifies for an A1 or PDA1 certificate based on their employment relationship, posting duration, and destination country.

- Document thoroughly: Maintain complete records including secondment agreements, certificate applications, employment contracts, and supporting documentation. This safeguards your organization in case of audits or disputes.

- Monitor assignment durations: Most certificates are valid for a maximum of 24 months. Establish internal tracking systems to flag upcoming expirations and avoid unintentional breaches of coverage limits.

- Account for enforcement differences: Recognize that different EU member states may apply the rules with varying degrees of strictness. Prepare accordingly, especially for high-risk or multistate workers.

- Seek specialist advice when needed: Complex secondments, such as those involving multiple jurisdictions or long-term assignments; require guidance from professionals familiar with both EU and UK social security coordination.

How TheHRchapter Can Help

When it comes to labour law compliance, cross-border employment, and employee relations. Here’s how we support you:

- Expert legal guidance: We provide strategic advice on international secondments and social security coordination, ensuring your postings comply with both UK and EU regulations.

- Tailored HR solutions: Our team works closely with your HR department to design policies and workflows that streamline certificate applications and reduce compliance risks.

- Proactive risk management: From tracking posting durations to preparing documentation, we help you anticipate potential pitfalls and avoid costly mistakes.

- Workplace harmony and compliance: Beyond international secondments, we support your organization in managing employee relations and fostering a positive, compliant working environment across borders.

Whether you’re managing a single secondment or building a global mobility strategy, TheHRchapter helps you stay compliant, minimize disruption, and support your international workforce with confidence. Contact us today!

Spread the Word!

Enjoyed what you’ve read? Help others discover it too! 📢 Share this article and let’s keep the discussion going.

Related Reads: Check out these other Articles!

Reskilling and upskilling for the digital age: How HR can lead the change in talent development and succession planning

Reskilling and upskilling for the digital age: How HR can lead the change in talent…

Expanding to Europe? Why Hiring Is Where Scale Usually Breaks (and How to Fix It Early)

Expanding to Europe? Why Hiring Is Where Scale Usually Breaks (and How to Fix It…

Agentic AI and HR Ethics: Best practices and ensuring compliance for employees and candidates

Agentic AI and HR Ethics: Best practices and ensuring compliance for employees and candidates There’s…