Understanding the Dutch Payslip: A practical guide for Startups and SMEs

As startups and small businesses in the Netherlands expand and bring on international talent, the payslip often becomes a source of confusion. Yet, it is a critical piece of employee communication and a reflection of your company’s commitment to compliance, transparency, and professionalism.

At TheHRchapter, we work with startups and SMEs to help them build people-first HR systems that support both the business and its people. One foundational component? Helping teams understand, manage, and communicate payroll clearly—starting with the Dutch payslip.

Why Dutch payslip clarity matters for growing teams

To many employees — especially international hires — a Dutch payslip is a wall of cryptic terms: loonheffing, premie ZVW, vakantiegeld, bijtelling. What should be a confirmation of income often becomes a point of confusion or doubt.

For growing companies, this confusion comes at a cost. But handled proactively, payslip clarity becomes an operational asset, a compliance safeguard, and a signal of trustworthiness.

1. Reduce friction in onboarding

The first payslip often becomes a test of how seriously a company takes its HR operations. For international hires, receiving a payslip filled with unfamiliar terms—without explanation—can undermine the onboarding experience and raise avoidable concerns.

Clear payslip communication during onboarding helps:

- Prevent unnecessary questions that slow down HR and operations teams.

- Reduce the cognitive load on new hires trying to navigate a new tax and employment system.

- Show early commitment to transparency and professionalism.

A new employee should never have to ask, “Did I get paid correctly?” That confidence must be built into your process from the start.

2. Build trust and improve retention

Startups and growing companies compete not only on compensation, but on clarity. A confusing payslip—especially when it includes deductions or fluctuating amounts—can quietly erode trust.

Transparent, well-structured payslip practices can:

- Demonstrate operational maturity, even in early-stage companies.

- Reinforce the employer brand as reliable, ethical, and detail-oriented.

- Empower employees to better manage their finances by understanding taxes, benefits, and accruals.

Trust built through clear communication reduces the mental overhead for employees and strengthens their long-term engagement.

3. Strengthen compliance and minimize risk

Payroll is a legal obligation, not just a financial transaction. In the Netherlands, mistakes in tax calculations, social security contributions, or reporting obligations can expose your business to audits, penalties, or employee disputes.

Proactive documentation and clear explanation of payslip components allow you to:

- Catch and correct payroll errors before they result in fines or back payments.

- Provide evidence of due diligence in the event of an audit or formal inquiry.

- Avoid misunderstandings around net vs. gross salary, tax credits, and allowances.

For startups scaling quickly or managing international payrolls, clarity is your first line of defense.

4. Enable scalable, efficient HR operations

When HR operations are limited, every repeated explanation is a cost. Answering the same payroll question ten times across a hiring cohort doesn’t scale—and it drains time better spent on high-impact work.

Standardized, accessible payslip documentation:

- Reduces the volume of recurring questions and support tickets.

- Creates a single source of truth that can be reused across cohorts, locations, and roles.

- Frees up operational capacity for strategic initiatives, like benefits design or HR automation.

As you grow, consistency becomes more valuable than improvisation. Payslip clarity is a small operational investment that reduces complexity downstream.

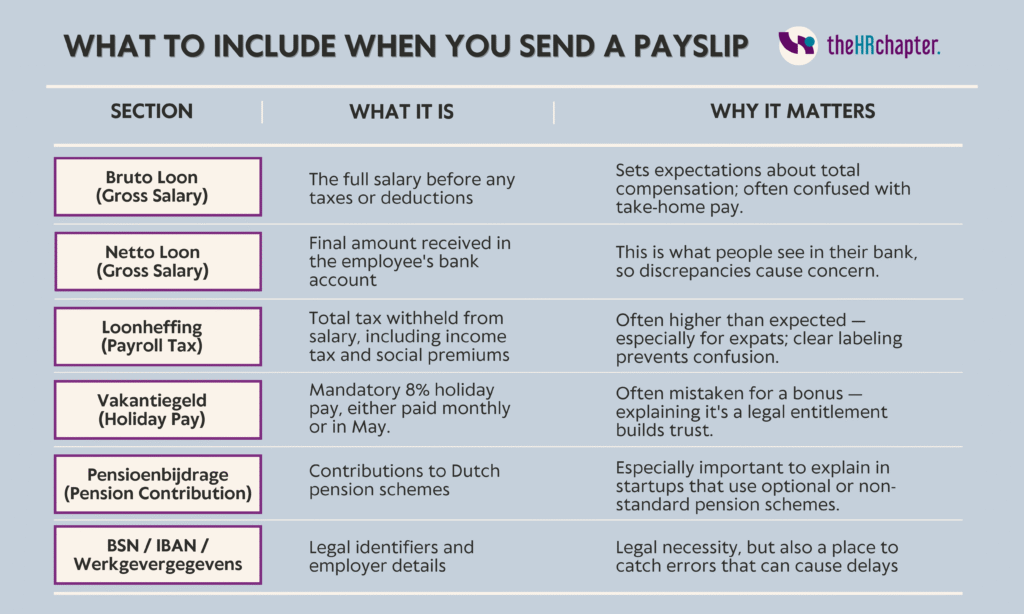

What to include when you send a payslip

You don’t need to turn every payslip into a training module. But adding a short, simple explanation of key components can make all the difference.

Here’s what we recommend including when you distribute payslips — especially for new hires or expats:

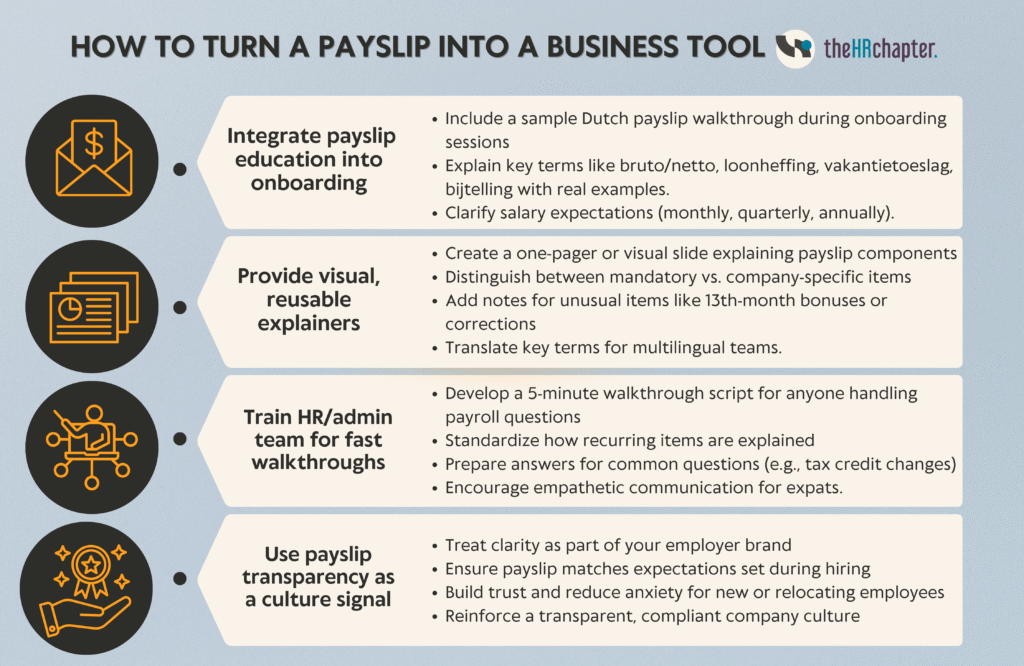

Make it a business tool — Not just a document

Most companies treat the payslip as a mandatory output: payroll goes out, a PDF lands in the employee’s inbox or portal, and that’s the end of the process. But for growing teams, especially those hiring international talent, the payslip can become a small but powerful part of your people strategy.

When used intentionally, a payslip helps set expectations, build trust, and reinforce operational clarity. Here’s how to turn it into a tool — not just a transaction:

1. Integrate payslip education into onboarding

Instead of letting the first payslip arrive without context, address it proactively during onboarding. This is your first opportunity to demystify Dutch payroll and signal transparency.

- Include a walkthrough of a sample Dutch payslip during onboarding calls or welcome presentations.

- Explain core terms like bruto/netto, loonheffing, vakantietoeslag, and bijtelling using real examples.

- Clarify what employees can expect monthly, quarterly (e.g., holiday pay), or annually (e.g., year-end bonuses).

2. Provide visual, reusable explainers

Design a simple one-pager or slide that breaks down a Dutch payslip visually. This becomes a reusable asset for new joiners, internal managers, or external payroll partners.

- Highlight which line items are mandatory (e.g., taxes, pensions) vs. company-specific (e.g., travel reimbursements, bonuses).

- Include notes about when unusual items may appear — such as 13th-month bonuses or corrections from prior months.

- Translate key terms side-by-side if you have a multilingual team (e.g., English + Dutch).

3. Train your HR or admin team for fast walkthroughs

Equip anyone who handles payroll questions — whether it’s your HR generalist, finance manager, or office admin — with a simple script or checklist for a 5-minute payslip run-through.

- Standardize the explanation of recurring fields.

- Prepare for FAQs like: “Why is my net pay lower this month?” or “What is ‘loonheffingskorting’?”.

- Practice empathy for international hires who may be navigating Dutch payroll, housing, and bureaucracy all at once.

4. Use payslip transparency as a culture signal

In fast-paced companies, culture isn’t just perks or mission statements — it’s how clearly and consistently you treat people. Transparency around salary structure, tax treatment, and benefits reinforces a culture of trust.

- Payslip clarity shows that you run a clean, compliant, and mature operation.

- It gives employees confidence that what they see in the offer letter aligns with what they receive in their bank account.

It removes “salary anxiety,” especially for new hires or international relocators.

Final thoughts: from compliance to culture

Forstartups and SMEs, the Dutch payslip isn’t just a payroll formality — it’s a cultural touchpoint. It’s one of the first moments where your company’s values around transparency, compliance, and employee care become real and tangible.

At TheHRchapter, we help founders, People Ops teams, and scaling companies turn HR paperwork into meaningful employee experience. From onboarding workflows to payroll clarity, we make sure your HR operations support both trust and growth.

If you’re hiring internationally or growing your local team in the Netherlands, don’t leave payslip communication to chance. Turn your payslip into a clear, confidence-building tool — not a source of confusion.

Need help translating compliance into culture? Contact TheHRchapter to learn how we can support your team with smart, scalable HR practices for modern companies.

Need help with other HR services for your business?

At TheHRchapter, we provide tailored solutions to guide startups and scaleups in choosing and implementing the best tools for hiring, onboarding, payroll, employee management and more.

Core HR Services

- HR Consulting: Provides expert advice on various HR matters, including policies, procedures, and compliance

- HR Services for Startups: Offers tailored solutions for startups, helping them establish a strong HR foundation.

- Payroll Services: Manages payroll processing, tax filings, and employee benefits.

Let us help you streamline your HR processes and achieve your business goals. Contact us today to get started!

Spread the Word!

Enjoyed what you’ve read? Help others discover it too! 📢 Share this article and let’s keep the discussion going.

Related Reads: Check out these other Articles!

Agentic AI and HR Ethics: Best practices and ensuring compliance for employees and candidates

Agentic AI and HR Ethics: Best practices and ensuring compliance for employees and candidates There’s…

2025: The Year HR Became Strategic – Key Lessons and Insights for HR Leaders

2025: The Year HR Became Strategic – Key Lessons and Insights for HR Leaders 2025…

Compliance Reset: 8 Key HR Reforms Dutch Employers Must Prepare for by 2026

Compliance Reset: 8 Key HR Reforms Dutch Employers Must Prepare for by 2026 By 2026,…